SafetyWing Travel Insurance: Complete Review From A Budget Adventurer

TRAVELING ON A BUDGET AND WONDERING IF TRAVEL INSURANCE IS ACTUALLY WORTH IT?

Most traditional travel insurance feels built for two-week vacationers—not long-term travelers. But what if you’re abroad for months, hopping countries, or working remotely?

I’ve used SafetyWing across three countries, from emergency dental in Iceland to dengue fever treatment in Bali—and it’s saved me thousands.

The best part? They offer two main plans:

- Nomad Insurance (emergencies only), available per trip or as a subscription

- Global Health Insurance for ongoing care, including routine visits

In this post, I’ll break down what’s covered, how much it costs, and my honest verdict after multiple real-world claims.

Get a quick SafetyWing quote now!

⬇ ⬇ ⬇

OVERALL WHAT IS THE BEST TRAVEL INSURANCE FOR BUDGET ADVENTURERS?

The best, most comprehensive, and personalized travel insurance is

SafetyWing Nomad Insurance

SafetyWing Products: What Are Your Options?

First off, on the homepage, you’ll see “Nomad Insurance” (for individuals and families) and the “Remote Health” (for companies).

👉We will only be talking about Nomad Insurance for individuals!!

⬇ ⬇ ⬇

For individuals, SafetyWing offers two main Nomad Insurance plans with different payment options (subscription vs. fixed). Understanding the structure is crucial for choosing what is best for you.

Quick Breakdown

⭐ESSENTIAL = Traditional emergency medical travel insurance

*Select the monthly subscription OR specific dates (for shorter trips)

⭐COMPLETE = Essential plan + routine health care

*Contract for 12 months only

Now, let’s dive a little deeper…

Plan 1: Essential Plan (Travel Medical Insurance)

This is SafetyWing‘s core travel medical insurance – emergency coverage for travelers.

This centers around medical emergencies and trip investments (lost luggage, etc.) as well as optional, extra coverage for adventure sports and electronics.

(See below for full details)

Perfect for:

• Budget travelers wanting basic emergency coverage

• Digital nomads needing flexible, continuous protection

• Adventure travelers who want optional add-on coverage

Two payment options:

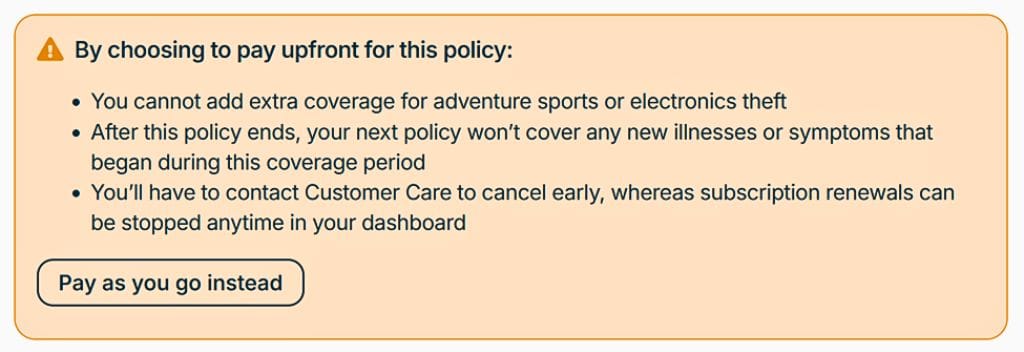

• Fixed date coverage – buy for exact trip dates (see below)

• Subscription model – auto-renews every 28 days until cancelled

If you’re looking for traditional emergency travel insurance, this is your best bet. The next step is determining the length of time you’ll pay for that coverage…

Planning a shorter trip?

Most budget travelers get confused because SafetyWing doesn’t clearly advertise their “fixed date option” on the main page.

What if you don’t need 4 weeks of coverage? Do NOT pay for a full month, then! Only pay for the specific days of your trip!

👉 Step-by-step to find “fixed date” option:

- Go to SafetyWing’s pricing page

- Select the Essential plan (fixed date option unavailable for Complete plan)

- At the bottom, check the box “pay in full for specific dates”

- Select your trip start and end dates (minimum 5 days required)

- See pricing at approximately $2 per day

Note: You’ll see a message that add-ons (adventure sports, electronic theft, etc.) are only available for the monthly subscription plan.

Plan 2: Complete Plan (Full Global Health Insurance)

Think of this as comprehensive health insurance that works globally – way beyond basic travel coverage.

This is the above Essential plan + routine medical!!!

(See below for full details)

Subscription only:

• 12-month commitment required

• Routine medical care included (checkups, dental cleanings, vision)

• Double the cost of Essential Plan

• Higher coverage limits across all categories

In the U.S. people are typically paying a monthly fee for regular health insurance, so this option is just combining that plus your travel insurance.

PLAN YOUR TRIP WITH MY FAVORITE RESOURCES:

➡Trusted HouseSitters: Discount code here!

➡Worldpackers $10 discount: Use code HEIDINIC

➡Purchase travel insurance here: SafetyWing

➡Save hundreds on flights: Beginner credit card hacking

SafetyWing Essential Plan: What’s Actually Covered

The Essential Plan is what 90% of budget travelers need.

Here’s the comprehensive breakdown.

😷Medical Emergency Coverage

The core protection that matters when things go wrong:

• Emergency medical expenses: Up to $250,000 USD

• Emergency dental care: Up to $1,000 USD (pain relief only)

• Motor accident coverage: Up to $250,000 USD

• Emergency medical evacuation: Up to $100,000 USD

• Repatriation of remains: Up to $20,000 USD

• Local burial expenses: Up to $10,000 USD

✈Travel Protection Benefits

Beyond medical – the stuff that protects your trip investment:

• Lost luggage coverage: Up to $3,000 USD ($500 per item max)

• Emergency flights home: Up to $5,000 USD

• Trip interruption: Coverage for family emergencies

• Travel delay coverage: Up to $100/day (max 2 days)

• Natural disaster accommodation: Daily coverage

• Political evacuation: When situations turn dangerous

⭐Optional Add-Ons (Game Changers!)

SafetyWing recently added optional coverage that fixes their biggest weaknesses:

Adventure Sports Coverage 🏔️

• Up to $100,000 USD for adventure activities

• Covers mountaineering, extreme sports, professional activities

• Essential for active travelers doing risky adventures

• Subscription plans only – not available for fixed date coverage

Electronics Theft Protection 💻

• Up to $3,000 per active insurance period

• Up to $1,000 per individual electronic device

• $6,000 lifetime maximum • Finally covers laptops, phones, cameras!

• Subscription plans only – not available for fixed date coverage

USA Coverage Enhancement 🇺🇸

• For non-US citizens traveling to/through America

• Covers the notoriously expensive US healthcare system

• Significant premium increase but worth it for US visits

SafetyWing is always adjusting to customer needs so it’s great to see these “add-ons” in recent years. The options are highly customizable.

The adventure sport I’m glad SafetyWing includes?

👉Via Ferrata

SafetyWing Complete Plan: Full Health Insurance

The Complete Plan is basically global health insurance – way beyond typical travel coverage.

Here’s the comprehensive breakdown.

What Complete Includes (Essential+routine🩺)

Routine medical care:

• Annual checkups and preventive care

• Dental cleanings and routine dental work

• Vision exams and prescription coverage

• Mental health counseling and therapy

• Specialist visits without referrals

Enhanced travel protection:

• Higher coverage limits across all categories

• More comprehensive trip interruption benefits

• Extended travel delay coverage

• Premium emergency evacuation services

Complete Plan Costs & Commitment

Pricing structure:

• Roughly double the Essential Plan cost

• 12-month commitment required (no monthly flexibility)

• Age-based pricing with higher rates for older travelers

Best for:

• Digital nomads replacing home country health insurance

• Long-term expats needing comprehensive healthcare

• People with ongoing health conditions

• Families wanting complete medical coverage abroad

With the Complete plan, you’re locked into a full year. Makes sense – otherwise people would just cram all their routine exams into a single month.

Real SafetyWing Costs: Budget Breakdown

Let’s talk actual numbers – because budget travelers need transparency.

⭐”Essential Plan” Pricing (Most Popular)

Subscription model (28-day cycles):

• Ages 18-39: $56.48 per 28 days (no US coverage)

• Ages 18-39: $75+ per 28 days (with US coverage)

• Ages 40+: Slight increases based on age brackets

Fixed date pricing:

• Approximately $2 per day for specific trip coverage

• Minimum 5 days required for purchase

• Available on pricing page – check “pay in full for specific dates” box

• Good for occasional travelers with defined itineraries

• No add-ons available (Adventure Sports, Electronics = only for subscriptions)

⭐”Complete Plan” Pricing

Full health insurance costs:

• Roughly $110-150 per 28 days depending on age

• 12-month commitment – can’t cancel mid-term

• Includes routine care that Essential doesn’t cover

👉👉Cost Comparison: SafetyWing vs Traditional

SafetyWing is a clear winner for budget travelers utilizing their Essential plan:

- Traditional 30-day travel insurance: $150-300

- SafetyWing Essential 30-day: $60-80

➡Savings: 50-70% for comparable basic coverage

The savings become massive for long-term travel where traditional insurers charge premium rates.

The math is simple: One medical emergency abroad typically costs $2,000-8,000+. SafetyWing costs less than $1,000 yearly for comprehensive protection.

What SafetyWing Doesn’t Cover (The Fine Print)

Every insurance has exclusions. Here’s what SafetyWing won’t pay for:

Medical Exclusions

❌ Pre-existing medical conditions (unless on Complete Plan after waiting period)

❌ Routine checkups and preventive care (Essential Plan only)

❌ Cancer treatment (except sudden onset new cancers)

❌ Pregnancy-related expenses (except emergency complications)

❌ Self-inflicted injuries

❌ Injuries from substance abuse

Travel Exclusions

❌ Trip cancellation before departure (only covers interruption)

❌ High-value electronics (without Electronics add-on)

❌ Professional sports participation

❌ High-risk adventure sports (without Adventure add-on)

❌ Known pandemic restrictions at time of purchase

👉The Reality Check

Most exclusions are standard insurance practice. SafetyWing’s exclusions aren’t worse than competitors – often better due to their flexible add-ons.

Often, people gripe about pre-existing conditions not being include, but you’re really never going to find that for traditional emergency travel insurance.

Real talk: Mental health coverage is a grey area, especially if you already have a diagnosis. If that’s you, reach out to SafetyWing directly – they can clarify your options, and you may need the Complete plan.

My Real SafetyWing Claims Experiences

Here’s where theory meets reality. I’ve filed multiple claims across different 3 different countries.

Here are my top TWO emergency examples from Iceland and Bali.

Spoiler alert: I’ve had 3 great experiences!

🦷 Emergency Dental Work in Reykjavik, Iceland

Day 1 in Iceland. Filling falls out while flossing. Exposed nerve = excruciating pain.

😓The situation:

• Iceland has insane healthcare costs for foreigners

• Emergency dental work easily $400+ out of pocket (honestly, I though it’d be more)

• Needed immediate treatment to continue my trip

🙂SafetyWing experience:

• Same-day approval for emergency dental treatment

• Direct billing with recommended dental clinic

• Full coverage after paying out of pocket first

• Zero paperwork hassles

Result: Continued my Iceland adventure budget intact instead of flying home with a ruined trip.

🦟Dengue Fever Treatment in Bali, Indonesia

Halfway through my 200-hour Yoga Teacher Training, I was slammed with fatigue and aches and immediately had to go to the hospital. I got the scary, and potentially life-threatening dengue fever.

😓The medical reality:

• Three doctor visits in one week

• Two IV treatments for severe dehydration

• Multiple medications for symptom management

• I skipped the ER monitoring (I just suffered at my retreat center in bed)

🙂SafetyWing coverage:

• Total medical costs: Over $300 USD (in other countries it would be over $1,000)

• My out-of-pocket: Paid upfront and got fully reimbursed!

• Reimbursement time: 15 days after submitting receipts

• Process: Simple online claim form + photo uploads

The bigger picture: Without insurance, I might have delayed treatment due to cost concerns – potentially life-threatening with dengue.

Claims Process Reality

☎Firstly, their customer service staff are amazing. Insurance is confusing, messy, and frustrating which is NOT how you need to feel in a crisis. You can quickly message a real human on their site and get fast answers.

🖥Secondly, SafetyWing‘s claims process is genuinely streamlined:

- Contact 24/7 hotline for emergencies (optional pre-approval)

- Seek treatment at recommended or approved facilities when possible

- Collect all documentation (receipts, medical reports, pharmacy bills)

- Submit online claim through member portal

- Upload photos of all documents

- Receive reimbursement typically within 2-3 weeks

Pro tip: For major medical situations, call their emergency hotline first. They can often arrange direct billing.

SafetyWing Pros and Cons: The Honest Assessment

After over two years using SafetyWing across multiple countries, here’s my brutally honest breakdown.

The Pros ✅

Pricing advantages:

• Unbeatable costs – consistently 50-70% cheaper than competitors

• $0 deductible on most claims (used to be $250)

• Transparent pricing – no hidden fees or surprise costs

Flexibility benefits:

• Buy while traveling – can purchase after trip starts

• Subscription model – automatic renewals, no coverage gaps

• Date-specific option – pay only for actual travel days

• Worldwide coverage – works in nearly every country

Modern features:

• Digital-first claims – everything online, no physical paperwork

• Fast processing – average 2.7 days for claim decisions

• 24/7 support – actual humans available for emergencies

• Add-on options – customize coverage for adventure sports, electronics

Family-friendly:

• Children under 10 get free coverage (max 2 per family)

• Competitive family rates for multiple travelers

The Cons ❌

Coverage limitations:

• Age restriction – maximum age 69 for new policies

• Essential Plan doesn’t include routine healthcare (pay more for the Complete plan)

• Add-ons cost extra – adventure sports, electronics protection

• US coverage significantly increases premiums

Policy restrictions:

• Pre-existing conditions not covered (Essential Plan)

• Limited home country coverage – only 15-30 days per 90-day period

• No trip cancellation – only trip interruption coverage

The Reality Check

👉Honestly, I’m struggling to find major cons. SafetyWing has addressed most complaints from early years by adding $0 deductibles, faster claims processing, and optional add-ons for previous coverage gaps.

The biggest “limitation” is that it’s travel insurance, not full health insurance – but that’s exactly what most budget travelers need. Plus, now they have their newer Complete plan.

Should You Choose SafetyWing? Decision Framework

Here’s how to decide if SafetyWing fits your travel style:

Choose SafetyWing Essential Plan If:

✅ You’re traveling for months (not just 1-2 week vacations)

✅ Budget is a major concern – you want solid coverage cheap

✅ You’re generally healthy – mainly need emergency protection

✅ You travel frequently – subscription model makes sense

✅ You do moderate adventure activities – basic coverage included

✅ You work remotely – need flexible, continuous coverage

Skip SafetyWing If:

❌ You need routine healthcare while traveling (get Complete Plan instead)

❌ You have significant pre-existing conditions requiring ongoing treatment

❌ You’re over 69 – they won’t cover you

❌ You only take short vacations – traditional insurance might be comparable cost

❌ You need extensive trip cancellation coverage for expensive trips

Consider SafetyWing Complete Plan If:

✅ You’re replacing domestic health insurance

✅ You need routine medical care while traveling long-term

✅ You have ongoing health conditions

✅ You can commit to 12 months of coverage

✅ Budget allows for premium pricing

If you want any travel insurance, SafetyWing has multiple options to customize and fit your travel needs.

FAQ’s About SafetyWing Travel Insurance

Is SafetyWing actually reliable for serious medical emergencies?

Absolutely. I’ve personally used SafetyWing for serious medical situations including dengue fever treatment requiring multiple doctor visits and IV treatments. They covered over $1,200 in medical costs with minimal hassle and fast reimbursement.

The key is contacting their 24/7 emergency line for major situations. They can arrange direct billing with hospitals and guide you to appropriate medical facilities. For minor claims, their online portal makes reimbursement straightforward.

Can I really buy SafetyWing after my trip has already started?

Yes! This is one of SafetyWing‘s biggest advantages over traditional insurers. You can purchase coverage after departing your home country, though there’s typically a waiting period before coverage becomes active.

This flexibility is perfect for spontaneous travelers or people who forgot to buy insurance before leaving. However, any medical issues that occur before your coverage start date won’t be covered.

Does SafetyWing cover COVID-19 related medical treatment?

Yes. SafetyWing treats COVID-19 like any other covered illness – including testing when medically necessary and treatment for symptoms. You’re covered as long as you didn’t contract COVID before your policy became active.

However, they typically don’t cover trip cancellation specifically due to COVID concerns, lockdowns, or travel restrictions if these were known risks when purchasing coverage. Always check current policy language as pandemic coverage continues evolving.

How do SafetyWing’s add-ons work and are they worth it?

SafetyWing ‘s add-ons address their historical weak points and are definitely worth considering for many travelers. Adventure Sports coverage ($100K limit) is essential if you’re doing serious outdoor activities. Electronics protection ($3K per period) finally covers laptops and cameras.

You can add or remove these options when renewing your subscription, giving you flexibility based on your current travel plans. The costs are reasonable compared to buying separate coverage elsewhere.

What’s the real difference between SafetyWing Essential and Complete plans?

Essential is traditional travel medical insurance – emergencies only, no routine care. Complete is full global health insurance including checkups, dental cleanings, mental health, and higher limits.

Essential costs ~$56-75/month with flexible subscription. Complete costs ~$110-150/month with 12-month commitment required. Most budget travelers choose Essential unless they need to replace their domestic health insurance entirely.

Final Thoughts on SafetyWing Travel Insurance

Here’s the Rundown: Without ANY travel insurance, you put yourself at risk and you might regret it later. SafetyWing travel insurance has genuinely revolutionized budget travel protection.

After two years of continuous coverage across three countries and multiple claims, I can confidently say it delivers on its promises.

They have flexible options to customize: trip duration, adding sports and electronics, and adding routine health coverage.

Their staff are responsive, thorough, and down-to-earth and the claims process is fast and fair.

If you’re traveling for more than vacation – whether budget backpacking, digital nomad life, or extended adventures – SafetyWing offers unbeatable value and peace of mind.

Get your personalized quote now

⬇ ⬇ ⬇

CLICK HERE

Ready to explore more ways to stay fit and healthy on your travels or plan epic budget adventures across the globe? Here are some ideas…

✴️Couchsurfing Safety Tips: How To Stay Safe While Traveling

✴️25% Off Trusted House Sitters Discount Code: How To Travel For Free 2025

✴️Beginner’s Guide to Free Points & Miles with Credit Card Hacking

✴️Travel Fitness: 11 Best Ways to Stay in Shape on Vacation

Follow me on Instagram to follow my travel & fitness journey